Cultural transformation, speed and scalability are key priorities for banks to engage the customer of the future.

Banking institutions have historically been limited by their physical footprints and redefining their capacity for innovation will require a deep cultural transformation, according to Luis Uguina, Head of Digital Transformation at Macquarie Bank.

Speaking at FST Media’s 10th annual Technology & Innovation – The Future of Banking and Financial Services conference in Sydney this morning, Uguina said that despite growing investment in upgrading legacy infrastructure and back-end systems, banks today are still unable to deliver the right “humanised” experience for customers and, as a result, are easily surpassed by more “agile and competitive” fintech disruptors.

“[Currently], it is impossible to work together with startups because it is difficult to maintain the speed and the fresh approach that every startup has in the market,” Uguina said.

“In my opinion, what we need to do is move beyond simply competing or collaborating with startups to the ‘bank-tech era’, where a bank is moving at the same speed as a startup.”

Uguina said the key difference between startups and banks was speed and scalability, as well as an openness for experimentation to deliver “a simplified view of the world” for customers.

“We are trying to deliver an incredible experience and we are trying more and more to provide incredible services but the customers are not engaged,” he said.

“Today, banks waste a lot of time. The idea is: are we able to change that? Yes, it is quite painful but it [can happen] quite fast.”

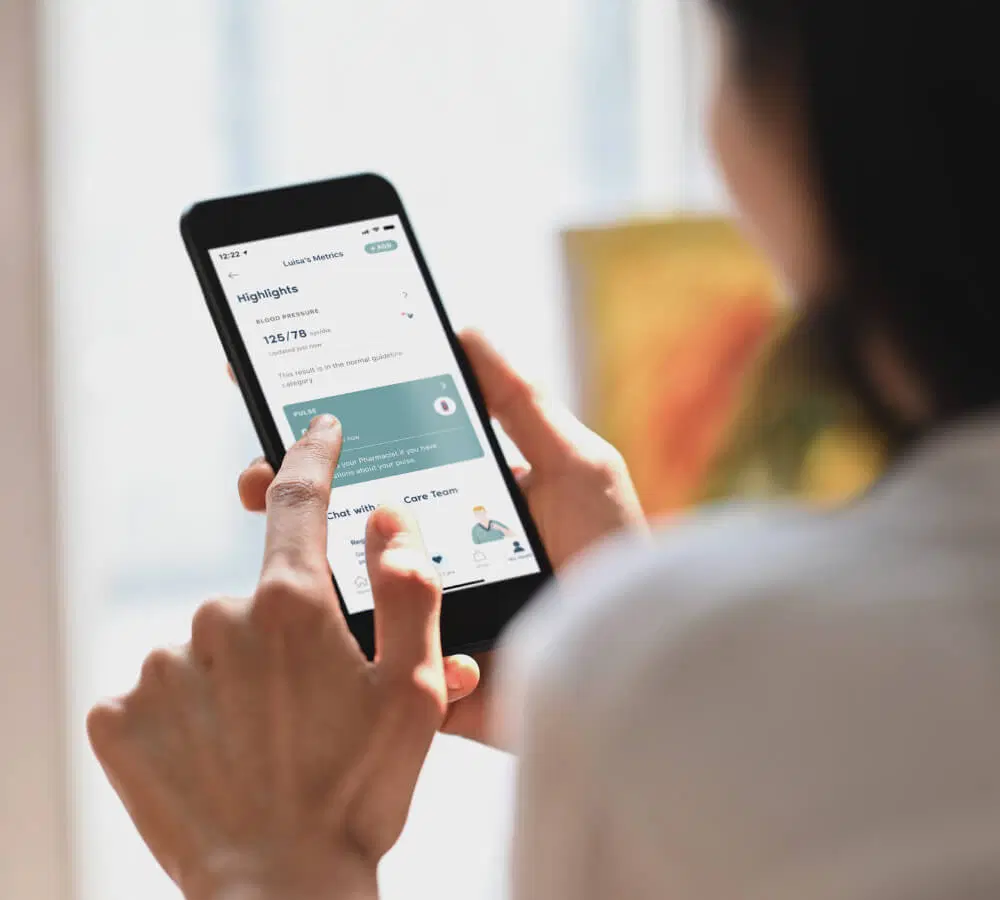

Uguina noted that ongoing digital transformation, “humanised product design”, real-time customer insights and having readily accessible application programming interfaces (APIs) were all vital for banks in the journey for customer engagement.

However, above all of these factors was ensuring a holistic approach to fostering a culture of innovation which, according to Uguina, meant providing the right climate for staff to “work fast, be happy” and constantly test new ideas by delivering product releases and functionalities on a daily basis.

“The most important thing for banks is learning to change the culture. Culture eats strategy for breakfast every day,” he said.

“Hope is not a strategy, you need to be sure of your team and that they are delivering incredible things.”

At Macquarie Bank, Uguina said the culture of the bank is grounded in the principle that the bank designs products and services attuned to “how people think, not for how the bank is built”.

“Our DNA at Macquarie Bank is having a culture that is willing to [embrace] change. We eat our own dog food: we test every product before it goes to market. If it’s not right for us, it’s not right for the customer,” he said.

“We want to deliver something that changes the way banks work. I want to deliver more and richer information to a customer, [and] that’s part of our new bank-tech era.”