The Bank of New Zealand (BNZ) has announced the acquisition of payments fintech BlinkPay, with the promise of expanding the NAB-owned bank’s open data capabilities as the country prepares for the roll out of its Consumer Data Right scheme.

BNZ said its investment would help to “accelerate and scale” BlinkPay’s innovation and product development, with a “focus on developing new Open Banking capabilities that improve financial outcomes for consumers and businesses across Aotearoa New Zealand”.

As a result of the acquisition, BlinkPay co-founder Adrian Smith will become chief executive.

Founded in 2015 and noted as among the first Maori-owned fintechs in NZ, BlinkPay touts itself as at the forefront of payment services development within NZ’s emerging Open Banking ecosystem. BlinkPay has established partnerships with NZ’s big four banks – ANZ, ASB, Westpac and BNZ – to support its payments ecosystem.

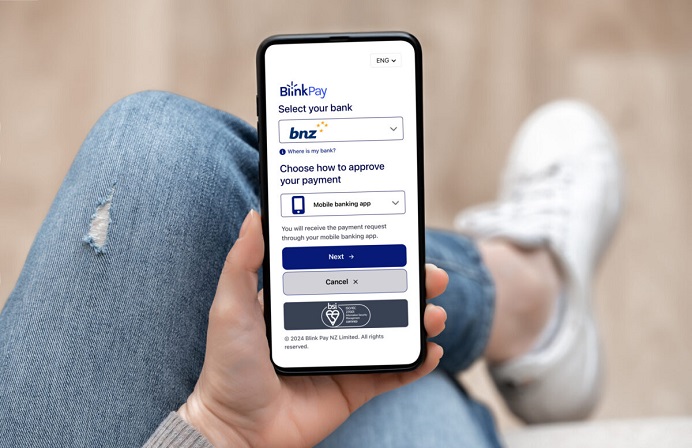

BlinkPay’s primary consumer offering, Blink PayNow, a payments gateway, enables direct account-to-account payments between customer and merchant bank accounts.

For merchants, BlinkPay can be integrated using Open Banking APIs into existing payments systems, including mobile and banking apps, to enable direct payments between consumer bank accounts and business bank accounts.

A soon-to-be-launched Blink Bills feature will also enable consumers to pay all bills via BlinkPay’s consolidated interface.

As well, a forthcoming ‘AutoPay’ function, a direct debit-like feature, will enable businesses to automatically deduct recurring payments from their customers’ accounts.

BlinkPay is also set to introduce an in-bank digital invoicing feature, enabling businesses to invoice customers, who can receive, store and pay their bills directly through their online banking platform.

BNZ chief executive Dan Huggins welcomed the investment in the emerging payments fintech, extendings its capabilities in Open Banking.

“This represents the next phase in our journey. With BNZ supporting BlinkPay’s innovation and agility, we can accelerate the development of new products and services that will benefit all New Zealanders.

“We’re proud to be investing in a team that has proven their ability to innovate and deliver.”

Digital wallet debut

BNZ earlier in the week announced the launch of New Zealand’s first digital wallet and point-of-sale (POS) app, ‘Payap’.

“Powered” by New Zealand-based fintech Centrapay and backed by the Bank of New Zealand (BNZ), the contactless digital wallet is designed to be compatible with all local banks.

Tapping the CDR scheme, the platform will provide consumers with an all-in-one facility to access local bank accounts, gift cards, and loyalty cards. At the consumer end, Payap users can make instant in-store payments directly from their bank accounts via QR codes; as well, a “low-cost” ecommerce solution will enable business users to accept payments online.

The app will enable peer-to-peer (P2P) transactions, record receipts, trigger rewards automatically during transactions, and manage shared payments.

Business users will also be able to create and manage loyalty programs and have full visibility of discounts and refunds via a “dedicated portal”; as well, a ‘store finder’ map within the app will display business locations and details to help boost visibility.

Payap is now open to new sign-ups ahead of its planned consumer launch in New Zealand in March 2025.

At launch, Payap will offer core capabilities for payments, acceptance, and rewards, with additional functionalities, such as P2P payments, to be “rolled out progressively throughout 2025”.