Digital disruption in wealth management should focus on engagement not technology, according to BNP Paribas Securities Services Australia and New Zealand managing director, David Braga.

Digital disruption in wealth management should focus on engagement not technology, according to BNP Paribas Securities Services Australia and New Zealand managing director, David Braga.

Braga said the emergence of new fintech firms in the wealth management sector would continue to grow in the coming years, however, this should not preclude asset owners and managers from continuing to meet customers’ needs.

“Technology is not the ultimate disruptor … the engagement and relevance models that new providers offer [is what] differentiates them from traditional financial institutions and generates traction from them,” Braga said.

“In this sense it isn’t only the delivery of the idea, but its relevance and timing that causes disruption.”

A key finding in a March 2015 report by AIST and BNP Paribas, titled 2025: What will the superannuation industry look like in a decade, was that 83 per cent of superannuation trustees expect to personalise each member’s fund experience by 2025.

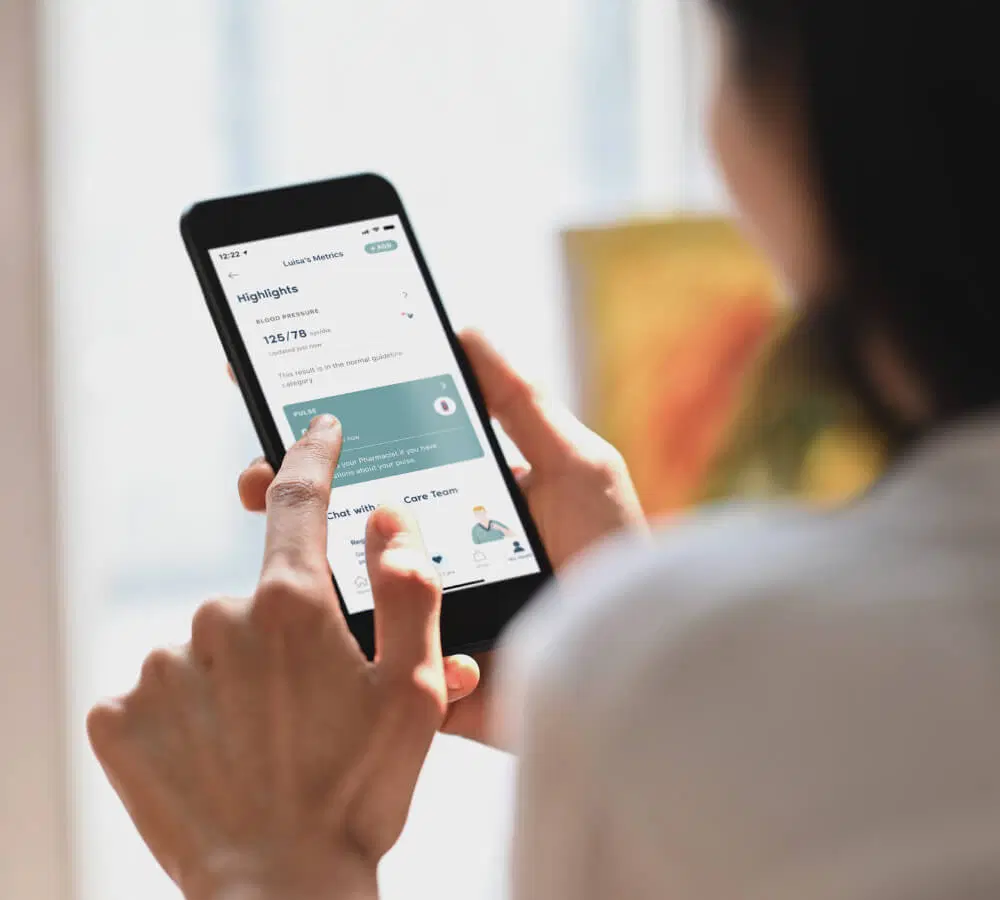

Braga said that technology will have a critical role to play in the development of this “more personalised” distribution model, as superannuation trustees looked to increase their engagement with their members.

“Technology will continue to be used to streamline costs and improve efficiencies as well as facilitate more rigorous compliance and regulatory reporting,” he said.

“As such, asset owners and managers alike need to continue to maintain and improve their relevance to their members and investors and provide what they want — or [face] the danger that someone else will.”

According to Braga, 80 per cent of asset managers expect to replace paper reporting to institutional clients with digital delivery within five years, with retail investors seen as the next step.

“We expect to see an increase in real-time, flexible and bespoke personalised data delivered on more mobile platforms,” he said.

“This will have a strong impact in engaging the younger segments of the population, so often considered apathetic about superannuation.”