Robo-advice offerings today do not offer any genuine interaction and more work is needed to help create a seamless interface with clients, according to Midwinter’s managing director, Julian Plummer.

Robo-advice offerings today do not offer any genuine interaction and more work is needed to help create a seamless interface with clients, according to Midwinter’s managing director, Julian Plummer.

As Midwinter gears up to launch its digital advice framework next month, Plummer said that automated investment tools represented an opportunity for greater innovation in financial planning, particularly as between 60 to 80 per cent of Australians do not currently have a paid relationship with a financial adviser.

“The confidence in robo-advice is still developing. All robo-advice [today] is scaled advice. It is objectives-based, because it only has one risk profile and it is self-servicing,” Plummer said.

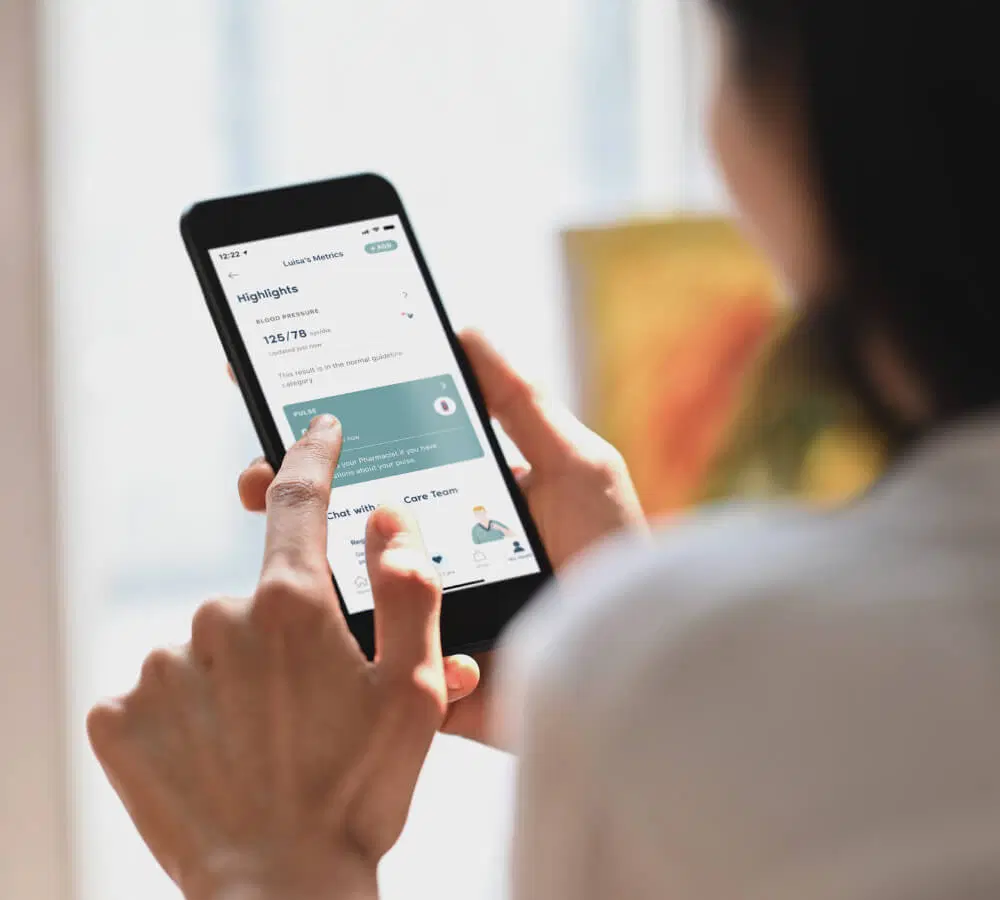

“We’re seeing this watershed moment where you have this growing confidence in [self-directed investors], plus a growing mobile-only consumer segment and that’s what we’re trying to tap into.”

A key feature of Midwinter’s new digital advice framework is that all the data that its cloud-based AdviceOS platform has on a user will be transported across into their digital advice account.

This will allow users to have greater insights into individual spending habits and behaviours in real-time as well as being able to seamlessly escalate from self-service all the way up to face-to-face advice, he said.

“We are introducing this concept of stochastic returns into [our] projections to allow the users the probability of advice and the probability of getting their goals…what you want to do with this digital advice framework is get every combination of advice available,” Plummer said.

“It’s more of a cohesive approach than just robo-advice. What we want to do is make financial planners be [at] the centre of their clients’ financial universe and this is the tool they can do it with,” he said.

According to Plummer, another key feature of the framework is its ability to produce a statement of advice (SOA) in real-time, as well as looking at where clients are in terms of their insurance requirements and providing a needs analysis based on client data.

“[Insurance] is something that traditional robo-advice ignores completely. Our digital advice framework provides a very simple insurance policy summary which gives you information on the client,” Plummer said.

“Digital SOAs are going to be the lingua franca, the language with which we speak to our customers. We want to be the default choice for financial planning software in Australia,” he said.

“What we want to do is make it as engaging as possible but at the same time still have all the [features] that a typical SOA has, such as advice fees, service fees and investment fees.”

A key focus for Midwinter’s roadmap for the digital advice framework is now the integration of self-managed superannuation funds via third parties using application programming interfaces (APIs).

Plummer confirmed Midwinter will begin pilot programs for the digital advice framework in the first week of April.