Leveraging social channels effectively to interact with customers has been identified as a key challenge for banks in Asia Pacific

Leveraging social channels effectively to interact with customers has been identified as a key challenge for retail banks in Asia Pacific looking to make the next step towards digital transformation.

However, very few banks are implementing social media strategies that are tangibly delivering revenue streams for the business, according to Ryan Hart, Principal Analyst for Forrester Research.

“How [banks] leverage social media to interact with customers is the ‘holy grail’ right now, from a customer engagement standpoint,” Hart said.

“Banks are trying to leverage social channels as well as develop online communities, [though] the big problem there is regulation: what can be posted on social media, what can be provided as advice.”

Frederic Giron, Vice President and Research Director at Forrester Research, argued that the increasing expectations of consumers today has meant that Asia Pacific banks are looking at the ways in which they can leverage social channels of interaction to engage a growing millennial customer base.

“Banks that will be successful are the ones that understand how to engage with their customers…They are removing the frustration, removing the complexity [and] embracing the channels and the touchpoints,” he said.

Giron noted that mobile messaging platforms like We Chat and Line could serve as key engagement channels as banks look to “win, serve and retain” a technology-empowered audience.

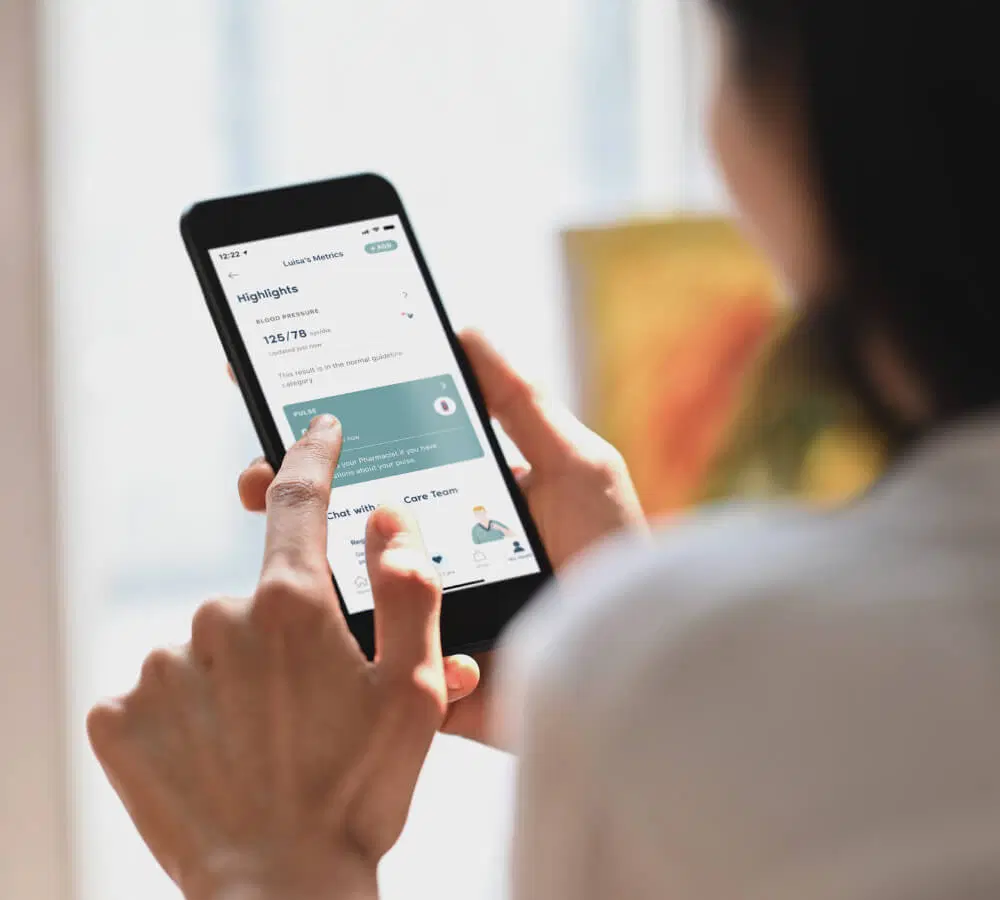

Shaun Tubb, Strategic Programme Manager and Head of Digital Banking at TSB Bank New Zealand, described digital innovation as a key enabler for changing customer behaviour, as banks respond to the pressures of engaging an increasingly mobile audience.

“Customers want to be able to manage their affairs how and when they want. Our culture is changing to look at problems differently, the traditional delivery models [like] branches wouldn’t allow this,” he said.

Cultural demands and differences

Giron identified cultural differences as being a key differentiator in the readiness of banks to adapt to customer demands and embrace digital transformation.

“Where in Malaysia, banks still have a product-led approach…in Australia, the more mature banks tend to have a more customer-centric approach,” Giron told FST Media.

“They are trying to better understand the customer lifecycle – how they can leverage technology in order to serve these customers across the different touchpoints throughout the customer journey.”

Tubb agreed, saying that leveraging technology to enhance customer experience is increasingly a priority for banks looking to survive in the digital age.

“We see digital as being a big leveller in terms of providing customers choice. Of course, banks are always going to be about security and stability first and foremost, but the change in customer behaviour is giving the customer choice in how they bank,” he said.

Data insights make all the difference

Gilles Ubaghs, Senior Analyst for Ovum further added that the challenge for banks embracing digital is enhancing their relationship with customers and leveraging data analytics to form a seamless customer journey.

“The key challenges for banks right now are getting an omni-channel perspective on their client base [and] creating a consistent experience for their consumer,” Ubaghs said.

Ubaghs said a key trend will be the way in which banks use these insights as dynamic customer demands increasingly sees a pivot towards the provision of tailored solutions in real-time.

“Banking technology is shifting and becoming more flexible. The key issue is not just about enabling these services, it’s about making them smarter,” Ubaghs said.

Ethan Wang, Research Director at Gartner, said Asia Pacific banks needed to adapt quickly and use different kinds of analytics to ensure their customers are “protected” from the threat posed by non-traditional financial disruptors and think-tank start-ups.

“Financial services organisations need to open [up] their retail banking ecosystems rather than use a traditional, enclosed banking system and learn from non-bank competitors [like Google and Apple] in order to create a frictionless experience,” Wang said.